If you are looking for Loan for Mineral Water Plant …

First, Correct your vocabulary

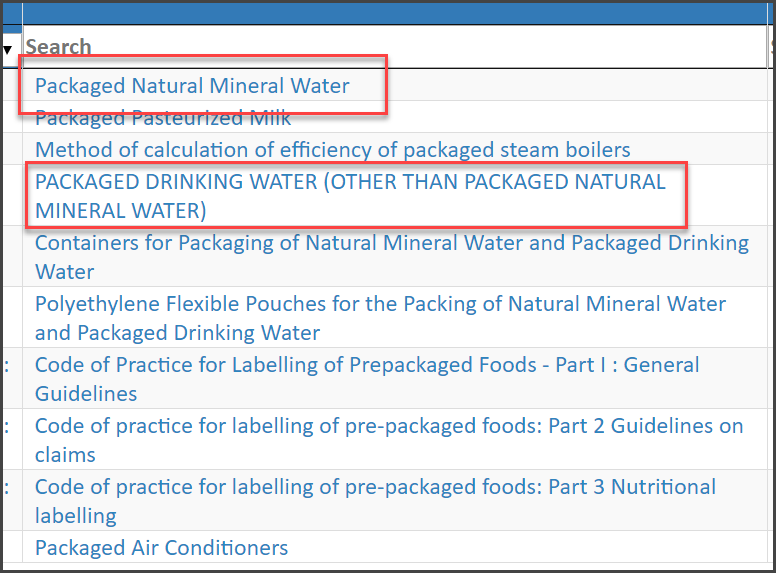

Why am I saying this ? It’s because generally you may say “Mineral Water Plant“, however, technically you should really mean that. There are 2 technical terms for this …

- Packaged Natural Mineral Water and

- Packaged Drinking Water ( Other than Packaged Natural Mineral Water )

These standards are set by the B.I.S. ; the body which issues an “I.S.I.” license to anyone who wants to sell Bottled Water in India. Hence it is very important for you to say this correctly. You should know first whether you are going to do a business in which of the 2 kinds of Bottled Water. All other kind of Bottled Water (Like Flavoured Water) are still not under the B.I.S. framework ; hence I won’t talk about that.

It is very important to talk correctly about the product for which you will be asking for a loan. The officers sitting at the opposite desk judge you by various methods. This is fundamental. It tells them that you have done sufficient groundwork.

How much Loan you need for your Mineral Water Plant ?

Exactly how much is the amount you will require for your mineral water plant is the Total Investment for this project. This is the Capital Investment, the money you require towards the machinery, land and other permanent establishments, one time.

Another type of amount which you might require is the ongoing kind of money for various needs such as day to day purchases & consumables, salaries, overhead expenses, fiscal expenses like Bank EMI, interest, Legal expenses and much more. This will be the Working Capital.

(# Please read a special article written on Cost Components to know more)

Once you are clear about these, you can draw your own financial projections. For this, you can take help from any financial consultant like a C.A. or some voluntary organizations like the B.Y.S.T. (in Pune, Hyderabad, Chennai) or De Asra (In Maharashtra only). The consultants will charge you more in comparison to these organizations, however, a consultant makes it specially for you.

What kind of report can you get from them

Usually people go for “Project Report” which is a very popular term for the Bankers. These consultants will offer you a project report for your Mineral Water Plant. A Project Report is a statement which tells the Bankers , on exactly

- How Much money the proposer wants ,

- and how is he going to Repay the same, in a stipulated time,

- and indirectly this also tells the bank, exactly how much money they will make from this, in form of Interest (which is the Banker’s Business)

In other words, the project report is a sales document for the entrepreneur and not just a “yet another legal document“.

It tells you how much money your business will make

First, it tells you exactly how much money your business will make from your proposed project. From this money, you will pay the Interest on the Loan for your Mineral Water Plant. Hence bankers will see first, whether your project really is capable of doing so. For you it may be the first time of setting up a Bottled Water plant; but for bankers, it’s an everyday affair. They might have seen many more cases than yours and the might be driven by some prejudices about this industry itself.

Your Document needs to convince them

The Project Report which you will take to the bankers, will need to convince the bankers that …

- The Industry is growing

- How your business is going to generate profits

- How will the banker benefit

- To do this, how much exact amount you require

Your inputs for making the project report are vital

The Consultant agency or an individual practitioner is not an expert in the industry domain i.e. Packaged Drinking Water. It’s you whose inputs will be required while preparing the project reports. So, it’s important that you should collect all this necessary information prior to going to these people.

How can you get these details ?

- Searching the suppliers online & approaching them individually 1 by 1

- Asking one of the existing plant owner & getting them

Yes, you actually will need to do a lot of legwork before you actually start going to a bank etc. However, a direction can be had by some experts in this domain like what we run a live training on “Idea to Actualization of a packaged Drinking Plant“. In this most of your initial doubts will get clarified. Since 2015, we have been conducting this, and there are many success stories. During this we do have a special session on “Cost Comparison” of various plant types & also train the participants on how to arrive at the capital cost exactly. Do check the next training & attend that.

Next Part is simpler …

Preparing your own capital

Bankers will never fund the entire amount. You will need to be ready with your own contribution. Usually 25-30 %. There are many agencies like the SIDBI, which helps you in the seed capital. Meaning, they will fund some 10% in the own capital (redcing your burden by 10%).

Get Ready with Collateral Security & Guaranteer

Collateral Security is some part of asset which you can pledge with the bankers till the tenure of your loan. Once you repay, it’s freed. For this, the consultants will help you a lot.

Guaranteer is a physical person, who knows you well, and stands guarantee that you will repay the loan and if not paid, Bank can collect the EMI or the interest from you.

(This sounds little harsh, but why will someone unknown fund you ? He will, provided he gets assurance besides the profit assurance by the Project Report.)

There are schemes where you don’t require a security or a Guaranteer

True. There are certain schemes from the GOI where you don’t require both of these or at least can skip the guaranteer. A Scheme called CGTMSE is already in place and many other schemes by the GOI. The institutions like the BYST will help you in getting that.

Look for Subsidy issued by the Govt Schemes

Subsidy is some kind of encouragement given in form of some fiscal benefit to the entrepreneur for setting up his enterprises, to encourage employment. There are 2 kinds of subsidies :-

- Subsidy by Central Govt

- Subsidy by respective state Governments.

Refer This Website for getting details about subsidies. However, here are a few notable points :-

- Central Govt has just 1 scheme running for years through which you get 15% investment back (On the machinery value).

- This amount should not be more than 15 Lakhs. In other words, projects above 1 Cr of investment in machinery won’t get this subsidy.

- This gets deposited into your bank account directly by RTGS, when it’s available & sanctioned.

- There are many consultants which may help you to get this. They will charge their professional fees.

- Besides the Central, State Govt also float certain subsidy schemes, kindly approach the District Industries Centre (D.I.C.) in your respective state for that. Agencies like De Asra might be of help to you in this.

- If you are applying for a subsidy; inform the bank in advance.

Summary of steps before applying for Loan for Mineral Water Plant

- Get proper domain knowledge

- Decide Which Kind of Project you wish to setup

- Calculate your exact need of Finance.

- Look for Subsidies

- Prepare a project report

- Apply to the Bankers

If you have doubts …

You can comment or ask a query in form of comments. Or can shoot a mail to mineralwaterpune@gmail.com or can simply fill a contact form

Thanks. Let’s keep in touch !